Germany’s pension system, long considered one of the strongest in Europe, is facing severe strain as demographic changes threaten its sustainability. With an ageing population and shrinking workforce, policymakers are seeking new ways to prepare citizens for retirement — including a controversial €10 per month share savings plan for children.

Mounting Pressure on the State Pension

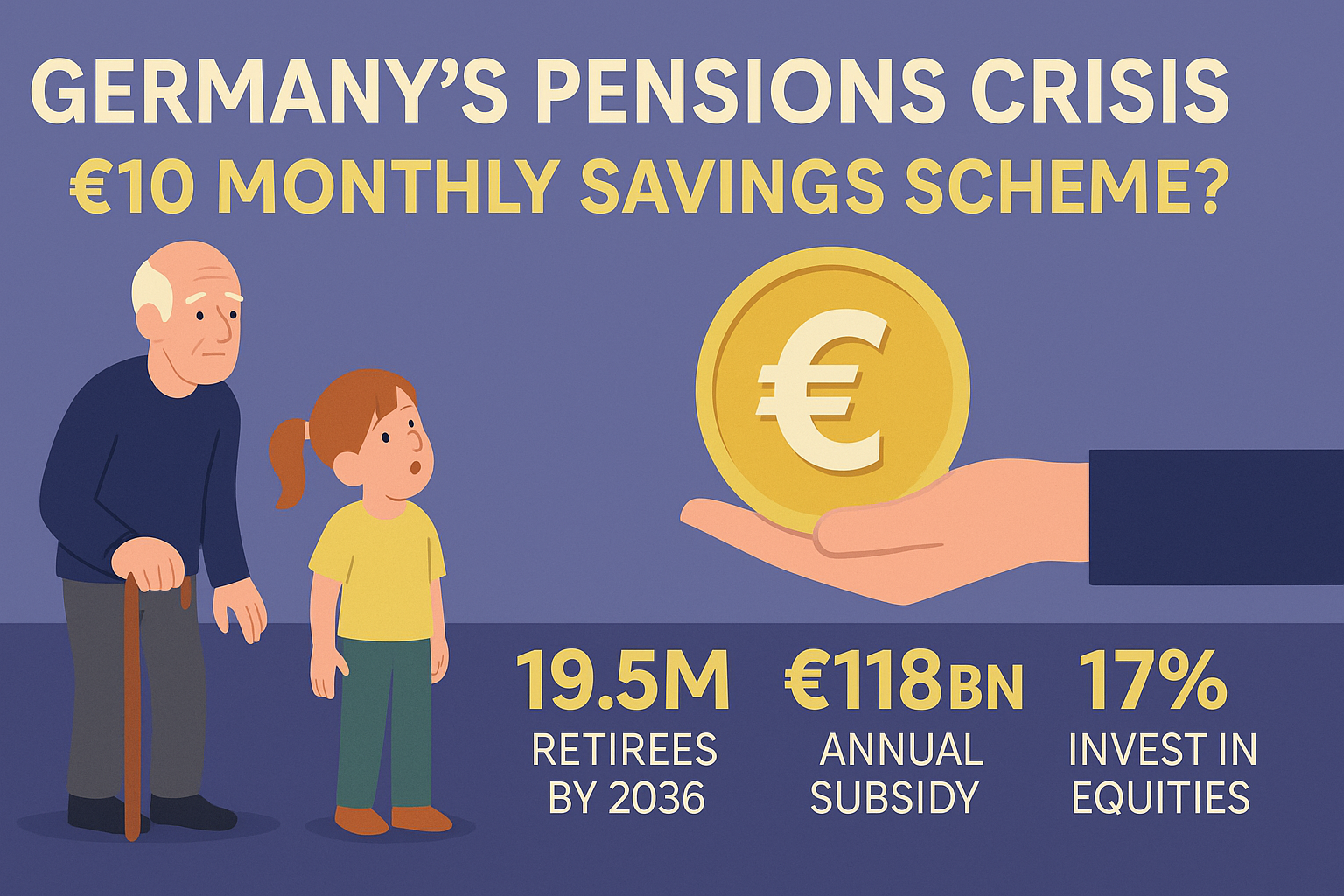

Germany’s pay-as-you-go pension scheme, established in 1889 under Otto von Bismarck, has endured wars and crises but is now confronting unprecedented demographic pressure. By 2036, nearly 19.5 million baby boomers will have retired, while only 12.5 million younger workers will have entered the labour market. This will lead to a 9% decline in the workforce, according to the Cologne Institute for Economic Research (IW).

By 2040, the ratio of workers to retirees is expected to worsen significantly, with 100 workers supporting 41 pensioners, compared with 30 today. To sustain the system, Germany already dedicates almost €118 billion annually — about a quarter of the federal budget — to cover pension shortfalls, a figure projected to rise further under current policies.

A Push for Private Investment

In response, Chancellor Friedrich Merz has urged young Germans to supplement public pensions with regular stock market investments. His appeal, made via YouTube, triggered sharp criticism from unions such as IG Metall, which dismissed the proposal as “out of touch with reality and dangerous,” insisting that the government should instead reinforce the state pension system.

Nonetheless, Merz’s government has outlined plans to promote capital-backed retirement savings, complementing public pensions with privately managed accounts. A key initiative is the “early start pension” subsidy, offering parents €10 per month to invest on behalf of children aged 6 to 18 in diversified share savings plans. These funds would remain locked until the children reach retirement age.

Lessons From Abroad

The scheme mirrors strategies in countries like the US and UK, which encourage channeling retirement savings into productive assets such as infrastructure and private equity. Currently, only 17% of German adults own stocks, funds, or ETFs, far behind the UK (39%) and the US (62%). This cautious culture has been reinforced by decades of political assurances that the state pension was “safe.”

Experts Divided

The proposal originated from Ulrike Malmendier, a behavioural finance professor at the University of California, Berkeley and member of Germany’s Council of Economic Experts. She argues that long-term investments in diversified portfolios almost guarantee returns: “It’s better if people experience this themselves rather than just hearing it explained.”

Still, scepticism remains. The Council of Economic Experts has repeatedly warned that pension benefits will inevitably decline while contribution rates rise, unless fundamental reforms are made. Critics fear the €10 subsidy, expected to cost €1.5 billion annually, is too modest to meaningfully address the looming pension shortfall.

A Larger Warning for Europe

Germany’s crisis highlights a broader challenge across the EU, where member states already allocate an average of 12% of GDP to pensions while grappling with similar demographic declines. Without reforms, the strain on public finances will deepen across the continent.