Shares in Britain’s largest banks dropped sharply on Friday as investors reacted to growing concerns that the government may impose new tax measures on the sector in the upcoming Budget to address a widening fiscal deficit.

Market Impact

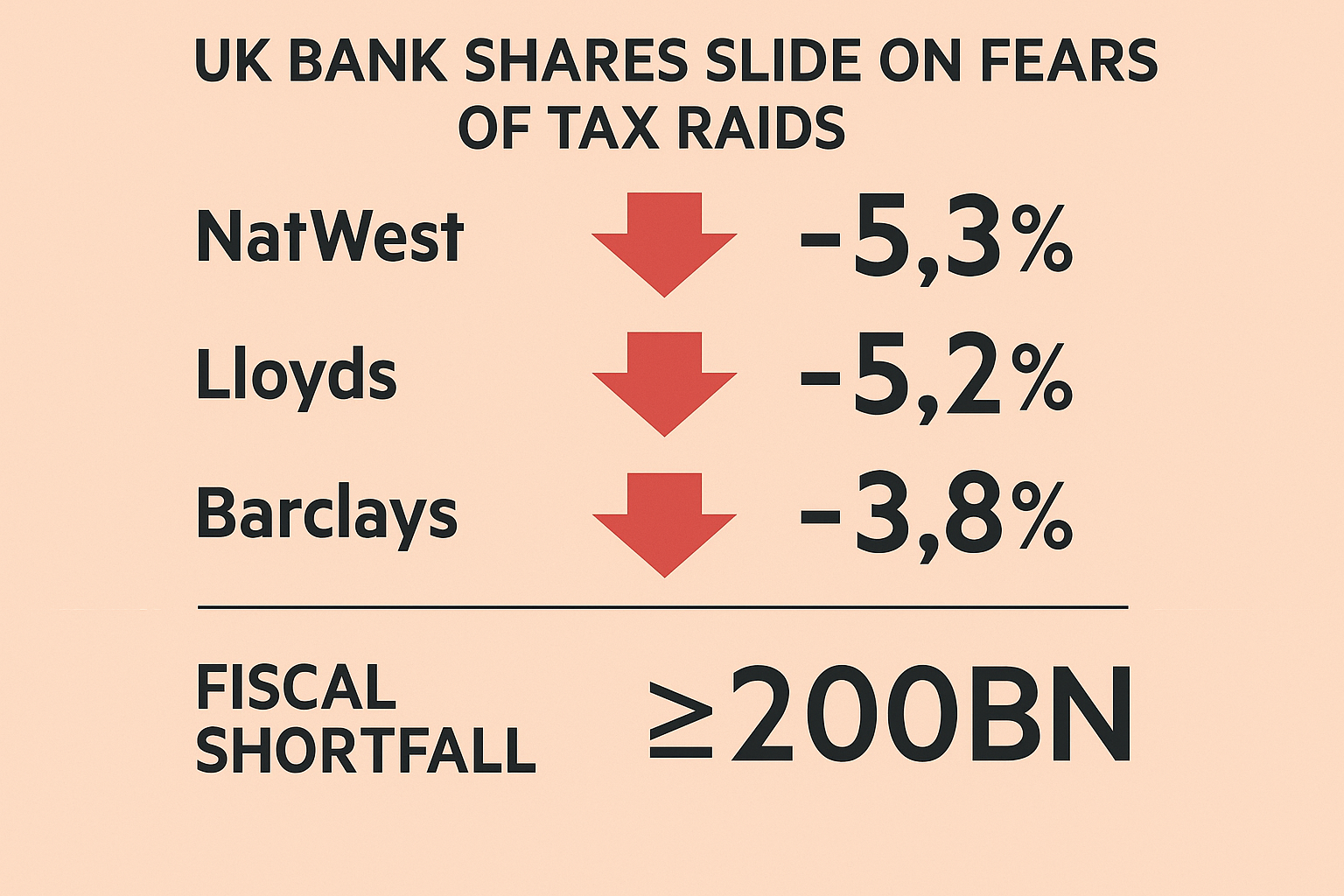

By early afternoon trading in London, NatWest shares had fallen 5.3%, Lloyds Banking Group was down 5.2%, and Barclays dropped 3.8%. The three lenders ranked among the worst performers on the FTSE 100.

The sell-off followed the release of a report from the Institute for Public Policy Research (IPPR), which suggested that the government could introduce a new levy on bank profits.

Fiscal Concerns

Economists estimate the UK faces a fiscal shortfall of at least £20 billion, fueling speculation that banks — given their recent profitability amid higher interest rates — could be targeted for a surcharge on profits or a sector-specific tax.

Investor Anxiety

The prospect of additional taxation has rattled investor confidence in the sector, already under pressure from regulatory scrutiny and broader economic uncertainty.

Analysts warn that any new levy could undermine profitability and reduce the attractiveness of UK banks at a time when lenders are still working to stabilize margins and manage exposure to struggling borrowers.