After years of decline, package holidays are experiencing a remarkable resurgence across the UK and Europe, as global conflicts, natural disasters, and frequent transport disruptions push travelers back towards the security of all-in-one bookings.

A Market Rebound Driven by Uncertainty

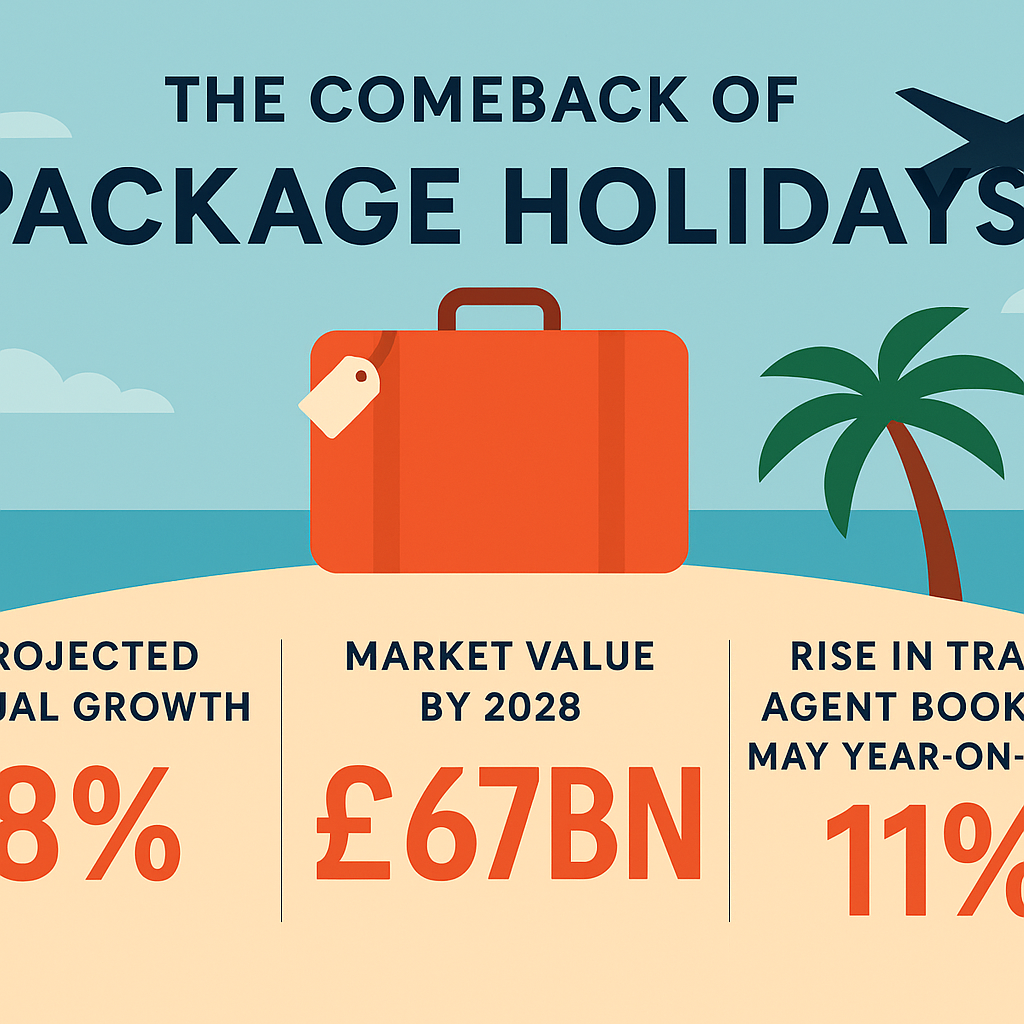

Data from Barclays shows that spending through UK travel agents has outpaced overall travel spending in 13 of the past 17 months. In May alone, bookings through travel agents increased 11% year-on-year, compared with just 3.5% growth in standalone flight bookings.

This revival comes as holidaymakers increasingly seek protection from the growing risks of flight cancellations, strikes, wildfires, and geopolitical conflicts. Travel companies such as Tui, Jet2, and On the Beach have seen renewed demand, reversing years of decline that had culminated in the collapse of Thomas Cook in 2019.

Strong Growth Forecast

According to consultancy OC&C, the UK, Irish, and German package holiday market is projected to expand at 8% annually, growing from £49bn in 2024 to £67bn by 2028. Shaun Morton, chief executive of On the Beach, noted that demand is “greater than it’s ever been,” highlighting increased consumer awareness of the rights and protections provided by package deals.

Rising Risks, Rising Demand

The return of package bookings is being fueled by the instability of global travel. Conflicts in the Middle East, French air traffic control strikes, and devastating wildfires in southern Europe have underscored the fragility of independent travel planning. Many families have faced last-minute cancellations or sudden evacuations in destinations such as Greece and Turkey, prompting a shift back to organized packages.

Donat Rétif, CEO of loveholidays, explained: “There’s always something happening — whether it’s unrest in the Middle East, an earthquake in Turkey, or fires in Rhodes. But with a package, we can easily redirect customers to safer destinations.”

Legal Protections and Consumer Confidence

Package holidays benefit from EU Package Travel Directive (PTD) protections, which safeguard consumers if a provider becomes insolvent and allow cancellations under specific circumstances. These protections, also enshrined in UK law, are reinforced by schemes such as ATOL in the UK and DRSF in Germany, which guarantee customer repatriation in the event of tour operator collapse.

Jet2’s chief executive, Steve Heapy, emphasized the simplicity for consumers: “Just imagine trying to get three different refunds from three credit cards at three different call centres. With a package, it’s one provider and one process.”

Shifting Demographics and Modernized Models

Once favored mainly by older travelers, package holidays are now attracting younger generations. Providers are offering interest-free repayment plans, flexible itineraries, and a wider range of destinations — from the Azores to Tarifa — appealing to a broader audience.

Companies like Jet2 have also gained traction with younger consumers through viral online content, turning their long-standing slogan “Nothing beats a Jet2 holiday” into a cultural reference, even featured at music festivals.

Meanwhile, online-first operators such as loveholidays have transformed the market, handling 5 million bookings in the past financial year, four times more than in 2019. Analysts describe this as “tour operating 2.0”, where asset-light models provide customized trips while retaining the legal protections of traditional packages.

Industry Response and Outlook

Even legacy giants are adapting. In March, Tui announced plans to expand its dynamic packaging deals, selling more seats on airlines outside its own fleet to increase flexibility. Industry experts say traditional providers are now selling more packaged holidays than ever.

Rich Robinson, head of hospitality and leisure at Barclays, summed up the shift: “It’s not just about choice; it’s about protection. People have faced too many cancelled holidays, and those experiences stay with them.”