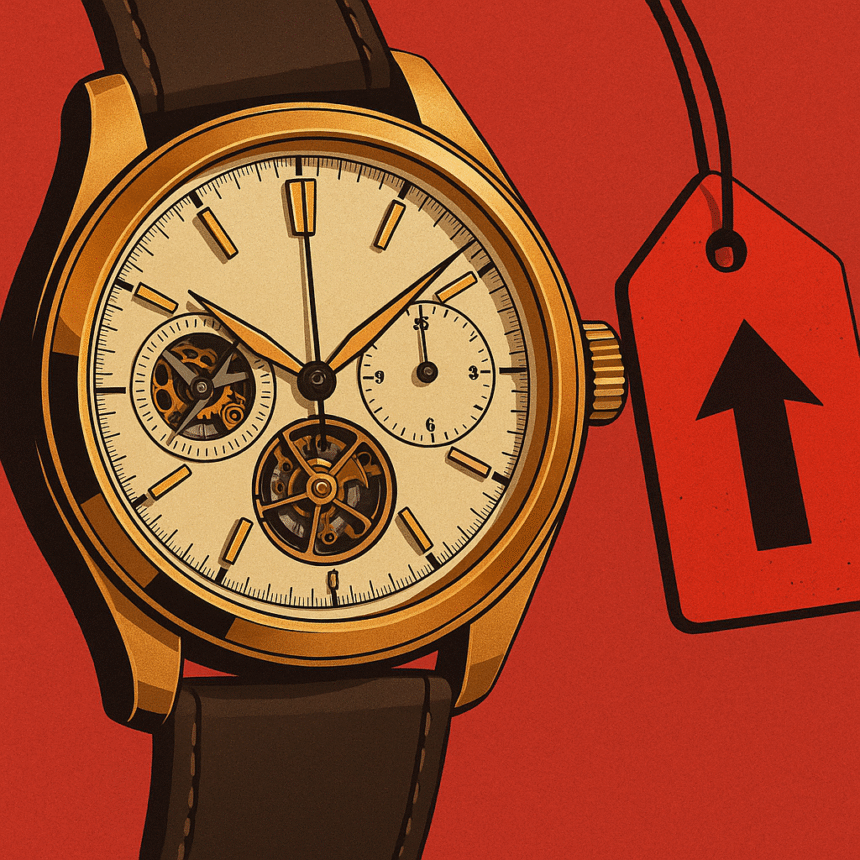

The Swiss luxury watch industry is bracing for a sharp blow after former US President Donald Trump announced a 39% tariff on Swiss imports, a move that is expected to drive up retail prices for American consumers and threaten sales in one of the industry’s most lucrative markets.

The new levy, set to take effect next week, places an unexpected burden on leading Swiss watchmakers such as The Swatch Group, Richemont, and UK-listed Watches of Switzerland, which distributes high-end brands including Rolex and Patek Philippe. According to analysts at Jefferies, all these players are likely to feel significant financial strain if the tariff is implemented as planned.

US Market Vital to Swiss Watch Exports

In 2024, the United States accounted for 16.8% of Swiss watch exports, representing sales worth approximately SFr4.4 billion ($5.4 billion). A 39% tariff would not only erode profit margins but also necessitate steep price increases, analysts warn. Jefferies noted that even under the previous 31% tariff proposal earlier this year, some retailers anticipated needing to raise prices “in the mid to high teens” to preserve profit margins.

The new rate far exceeds the 15% tariffs imposed on neighboring European Union countries and significantly raises the cost burden on Swiss exports. As a result, shares in Watches of Switzerland dropped 8% in London trading following the announcement.

Luxury Watch Buyers May Absorb the Shock — For Now

Brian Duffy, CEO of Watches of Switzerland, described the tariff hike as “a shock,” but expressed confidence in the company’s ability to weather the storm. He noted that half of the company’s business is based in the US, and much of it depends on long waiting lists for luxury models — a factor that may allow retailers to pass on higher costs without immediately affecting demand.

“Demand for watches still exceeds supply,” Duffy said, noting that the company is working with brand partners to mitigate the impact by accelerating shipments and fulfilling orders ahead of the tariff implementation.

However, Duffy acknowledged the limitations: “We can only bring in so much stock, and if this holds, watches will get more expensive in the US.”

Pressure Mounts on Supply-Constrained and Mass-Market Brands

According to Barclays, even elite brands like Rolex and Patek Philippe — which deliberately limit production to preserve exclusivity — may struggle with price increases of this magnitude. Brands that are not constrained by supply, however, will likely find it more difficult to raise prices without damaging sales volumes.

Meanwhile, Swiss watch exports have already shown signs of weakening. June export data indicated an 18% drop in shipments to the US year-on-year, reflecting both the strengthening Swiss franc and softening demand. The Swiss watch sector as a whole recorded a 2.8% annual decline in 2024 exports, marking the first drop since the post-pandemic rebound in 2020.

Industry and Local Leaders React

Industry figures and business groups have denounced the tariff decision. Vincent Subilia, director of Geneva’s Chamber of Commerce, labeled the move an “irrational US tax policy,” adding that “the US consumer will unfortunately have to pay the price.”

Oliver Müller, founder of watch consultancy LuxeConsult, criticized the tariffs as unfair and unnecessary. “These punitive customs duties are particularly unjust because the Swiss watch industry poses no threat to US manufacturers,” he said. “The US watch industry — with the exception of a few niche brands — essentially disappeared long ago.”

Tariff Comes Amid Broader Swiss-US Trade Tensions

The watch industry tariff is part of a broader US trade move that includes a 39% tariff on Swiss goods, announced days before its scheduled implementation on August 7. The Swiss government has expressed “deep regret” and called the move a “shock,” especially after hopes of reaching a bilateral trade deal were dashed.

While Switzerland continues to seek a negotiated resolution, time is running out, and watchmakers are preparing for what could be a lasting adjustment in their US business strategies. For now, Swiss precision may come with a significantly higher price tag for American collectors.