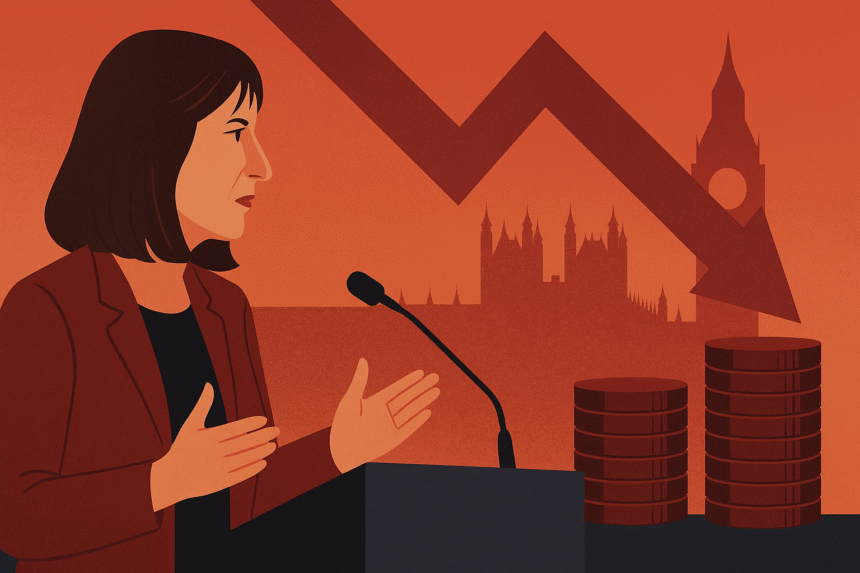

Chancellor Rachel Reeves is preparing for her second Budget, signaling a new round of tax increases just three weeks before the official announcement on November 26. The move represents a major political gamble — one that could define her tenure and test her long-term economic vision.

A Break from Her Own Promise

Reeves had pledged that her first post-election fiscal package, unveiled in 2024, would be “one and done.” However, her recent Downing Street speech hinted at a possible U-turn, with income tax rises now under consideration to address mounting fiscal pressures.

“All will have to contribute,” she said, warning that unforeseen challenges have deepened the strain on public finances. Treasury insiders reportedly debated whether to impose a single large income tax rise or adopt a “Swedish smorgasbord” of smaller measures to fill the fiscal gap — a nod to Treasury minister Torsten Bell’s Scandinavian-inspired approach to public finance.

Stabilizing the Markets and Building Fiscal Resilience

A key goal of Reeves’ announcement was to reassure financial markets that Labour remains committed to fiscal discipline. She emphasized that her government would not dilute its fiscal rules despite the political risks, aiming to sustain low borrowing costs and encourage the Bank of England to consider interest rate cuts in the near term.

Reeves currently maintains a slim £9.9 billion buffer against her own fiscal targets but vowed to strengthen Britain’s financial resilience to withstand “global turbulence.” Markets reacted calmly, with no major movement in government bond yields following her statement.

Shifting Blame and Framing the Narrative

Reeves also used the speech to firmly attribute the country’s current economic troubles to Conservative mismanagement, citing Liz Truss’s mini-budget, sluggish productivity, and years of underinvestment. She accused the previous Tory governments of “gutting” public services and delivering a “rushed and ill-conceived Brexit” that compounded economic stagnation.

“It is my job to deal with the world as we find it, not the world that I might wish it to be,” Reeves remarked.

The Productivity Problem

The chancellor’s challenge is compounded by an expected downgrade from the Office for Budget Responsibility (OBR), which may lower the UK’s productivity forecast by about 0.3 percentage points — creating a significant shortfall in government revenues. Reeves ruled out sidelining the OBR but maintained confidence in long-term reforms such as overhauling planning regulations and sustaining public investment.

“Forecasts are based on past data. I don’t believe the past is our destiny,” she asserted.

Political Risks and Long-Term Bets

Despite warnings that new tax hikes could damage Labour’s political standing, Reeves said she was willing to take the risk to restore fiscal health. “We have got to do the right thing. We can’t keep on racking up debt,” she stated.

Her critics argue that Labour, like the Conservatives before them, risks relying on short-term fixes. Reeves’ first Budget in October 2024 was already the largest tax-raising fiscal event in decades, yet it left the Treasury with minimal flexibility amid rising global interest rates. That vulnerability led to an unplanned fiscal correction in March — and now, a potentially more painful one.

A Question of Political Survival

As Reeves presses ahead with tough measures, questions linger over whether she will remain chancellor long enough to witness the long-term benefits she envisions — such as reduced borrowing costs, fiscal stability, and potential tax relief before the next election.

Her strategy hinges on convincing both voters and markets that discipline today will yield prosperity tomorrow — a test that may determine not just her legacy, but Labour’s economic credibility for years to come.