Mediobanca shareholders have voted against a proposed €6.3bn takeover of wealth manager Banca Generali, in a decision that could shape the future of the Italian lender amid takeover pressure from rival Monte dei Paschi di Siena (MPS).

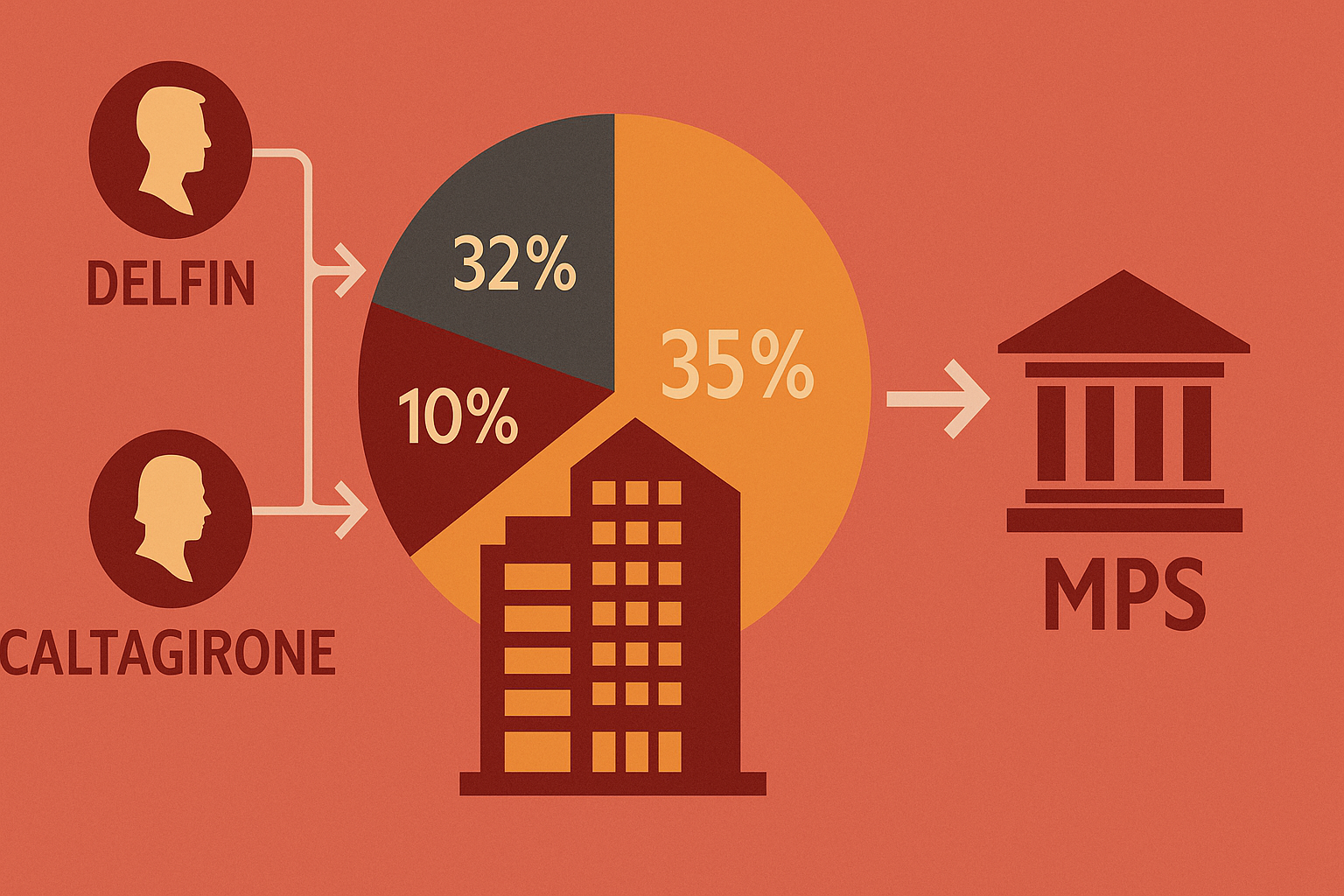

At an extraordinary shareholder meeting in Milan, results showed 32% of investors abstained, 10% rejected the deal, and 35% voted in favor. The rejection represents a setback for Mediobanca’s chief executive, Alberto Nagel, who had promoted the deal as a key defense strategy against MPS’s hostile bid.

Key Shareholder Positions

- Delfin, the holding company of the Del Vecchio family and Mediobanca’s largest shareholder, abstained.

- Francesco Gaetano Caltagirone, a construction magnate and the second-largest shareholder, voted against.

- Combined, Delfin and Caltagirone hold around 28% of Mediobanca.

- Institutional investors representing roughly 25% of share capital supported the acquisition.

Nagel described the outcome as a “missed opportunity,” suggesting that shareholder conflicts of interest played a major role in the rejection. Both Delfin and Caltagirone also hold stakes in Generali (Banca Generali’s parent company) and in MPS, further complicating the vote.

Strategic Context

Nagel’s plan envisioned financing the Banca Generali acquisition by selling Mediobanca’s 13% stake in Generali. The deal was seen as a critical countermeasure to MPS’s ongoing takeover attempt, which Nagel has dismissed as “senseless and value destructive.”

Under Italian law, companies subject to a takeover cannot pursue acquisitions without shareholder approval, making Thursday’s vote pivotal.

Next Steps and Market Impact

Mediobanca investors now have until September 8 to decide whether to accept MPS’s discounted takeover bid, which is still below Mediobanca’s market valuation. The Italian government remains MPS’s largest shareholder but has recently been reducing its stake, with portions being acquired by Delfin and Caltagirone.

As of this week, official filings show that 19.4% of Mediobanca’s shareholders have already accepted the MPS offer, up from zero the previous week.

The rejection of the Banca Generali deal marks the latest twist in an ongoing struggle over control and direction in Italy’s financial sector, where overlapping crossholdings, political influence, and investor rivalries continue to drive uncertainty.