Eurasian Resources Group (ERG), the mining conglomerate formerly listed in London as ENRC, has posted its largest annual loss since leaving the London Stock Exchange more than a decade ago. Rising borrowing costs and foreign exchange losses weighed heavily on the privately held company’s 2024 results.

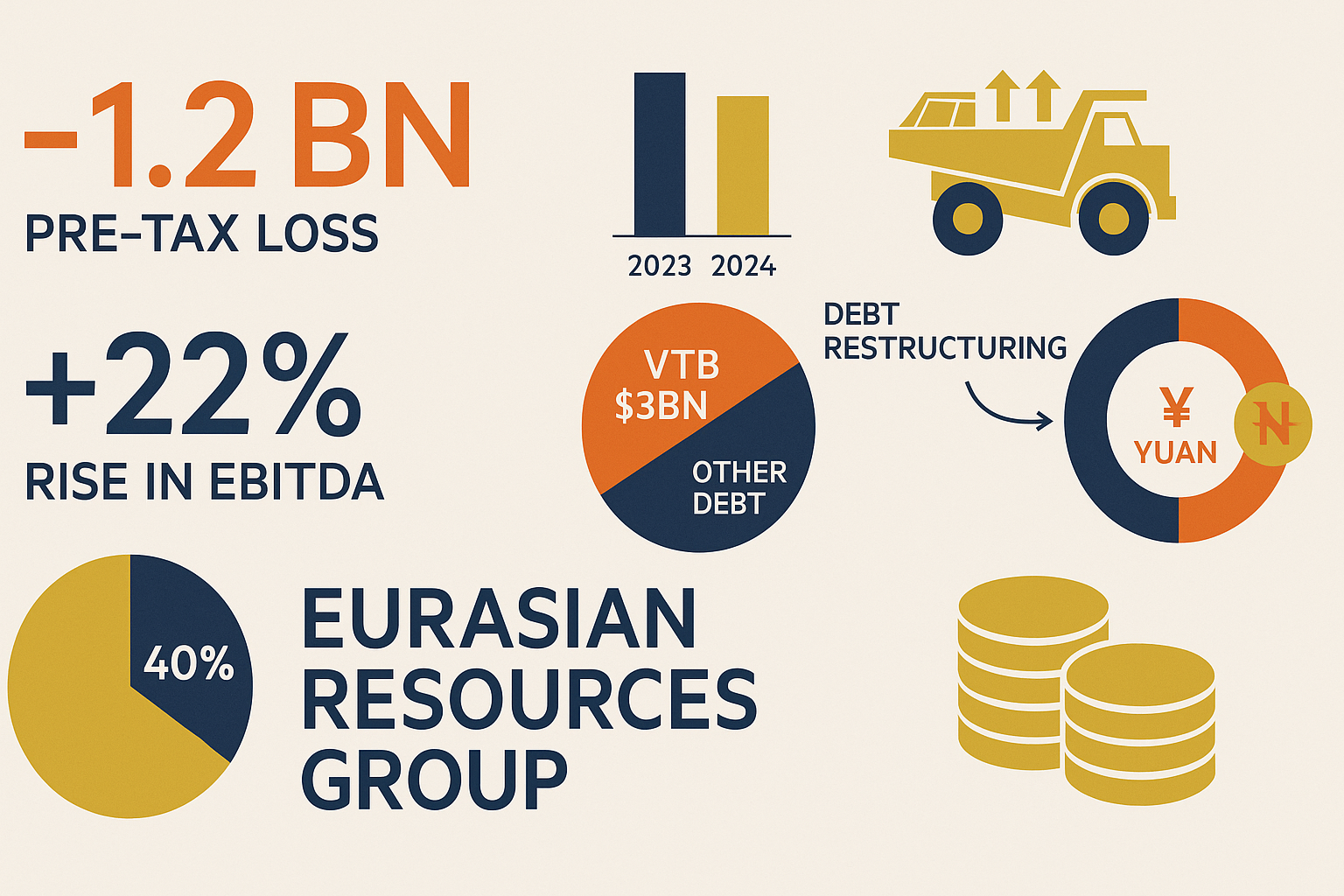

According to accounts filed in Luxembourg, ERG recorded a pre-tax loss of $1.2bn last year, a sharp increase from a $44mn loss in 2023. The company operates mines in Kazakhstan, Brazil, and the Democratic Republic of Congo, producing metals such as copper, aluminium, ferroalloys, iron ore, and alumina.

Leadership and Ownership Struggles

The results come during an internal power struggle. Shukhrat Ibragimov, the son of one of ERG’s founding Kazakh oligarchs, is seeking to buy out his late father’s partners to gain a majority stake. Ibragimov, who became chief executive in October, has pledged a new strategy to leverage rising global demand for the group’s key commodities.

Financial Pressures

The loss was primarily driven by financing costs of $1.2bn, nearly double the previous year, and foreign exchange losses of $600mn, up from $88mn in 2023. The company attributed much of this to the 15% depreciation of the Kazakhstani tenge against the US dollar. Although ERG reports revenues in dollars, its Kazakh assets operate with the tenge as their functional currency.

Debt servicing and restructuring also weighed on results, costing $568mn, an increase of $135mn year-on-year. Despite these pressures, ERG reported a 22% increase in EBITDA to $1.9bn, supported by higher production volumes across several key commodities.

Links to Sanctioned Russian Banks

ERG has significant financing ties to Russian banks VTB and Sberbank, both sanctioned by the EU and US after Russia’s 2022 invasion of Ukraine. As of 2023, ERG owed VTB $3bn. In 2024, the company restructured the facility, converting about $2bn of dollar-denominated debt into Chinese yuan to comply with international sanctions. A similar restructuring was carried out with Sberbank in the previous year.

Dividend Payment to Kazakhstan Government

The group also disclosed it had paid a $366mn dividend earlier this year to the government of Kazakhstan, which owns 40% of ERG. The payment had been declared in earlier years but was delayed due to “legal restrictions” in Luxembourg that have since been lifted.