Canary Wharf Group (CWG) has reported a modest rise in the value of its office portfolio, signaling early signs of recovery for the east London financial hub after several years of falling valuations and uncertainty over office demand.

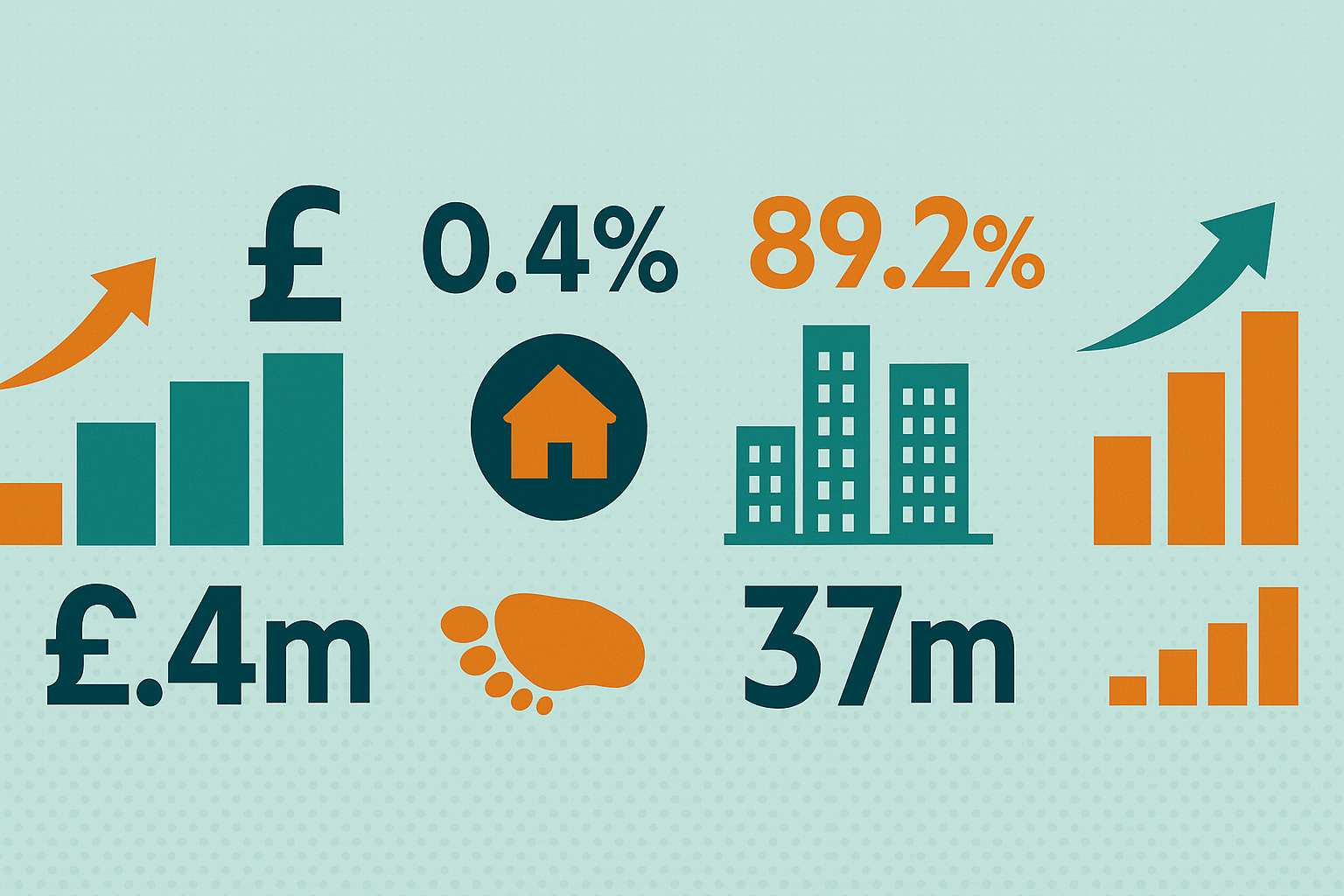

Independent valuers increased the worth of CWG’s offices by £10 million, or 0.4 per cent, to £4.3 billion at the end of June 2025. The uplift comes after a broader improvement in City of London office valuations, suggesting a rebound in investor and tenant confidence despite the challenges of hybrid working.

Strongest Leasing Demand in a Decade

CWG, jointly owned by Brookfield and the Qatar Investment Authority, said leasing activity had reached its highest level in 10 years. More than 450,000 sq ft of new office leases have been signed so far in 2025, putting the group on track to surpass the 700,000 sq ft leased in the whole of last year.

“These transactions highlight the continued appeal of Canary Wharf and show that office demand is being driven by business growth and a clear desire among occupiers to bring their teams together to collaborate,” said Becky Worthington, CWG’s chief financial officer.

The company also reported growing demand for both office and retail assets, underpinned by record footfall and rising rents. Foot traffic across the estate exceeded 37 million visits in the first half of the year, up 4 per cent from 2024.

Pandemic Legacy and Market Shifts

Like many commercial districts worldwide, Canary Wharf was hit hard by the rise of hybrid working following the Covid-19 pandemic, with occupancy levels slipping as major tenants, including Clifford Chance and State Street, relocated.

However, the district is now seeing renewed momentum as employers encourage staff to return to offices. Nationwide, the UK recorded 20.3 million sq ft of office space take-up in the second quarter, the highest rolling 12-month figure since 2022, according to CBRE.

CWG’s office occupancy rate rose to 89.2 per cent, compared with 88.5 per cent a year earlier. The Financial Times recently reported that valuations of some of Canary Wharf’s largest office towers had increased for the first time in three years.

Big-Name Moves and Diversification

The estate has suffered notable tenant departures but has also secured new commitments. Visa is in talks to relocate its European headquarters to Canary Wharf, while HSBC has reversed plans to vacate entirely. Fintech firms Revolut and Zopa have also taken new premises, signaling growing interest from technology companies.

To broaden its appeal, CWG has been investing in its retail and leisure offering, introducing restaurants such as Din Tai Fung and Lina Stores, aimed at attracting both office workers and the district’s growing residential population.

Broader Portfolio Performance

Despite the uptick in office values, CWG reported a 6.6 per cent fall in the overall value of its holdings, now totaling £6.3 billion, reflecting declines in properties earmarked for sale.

Nevertheless, the increase in office valuations and leasing demand provides optimism that Canary Wharf may be turning a corner after years of uncertainty, with the estate adapting to new patterns of work and lifestyle in London’s evolving commercial property landscape.