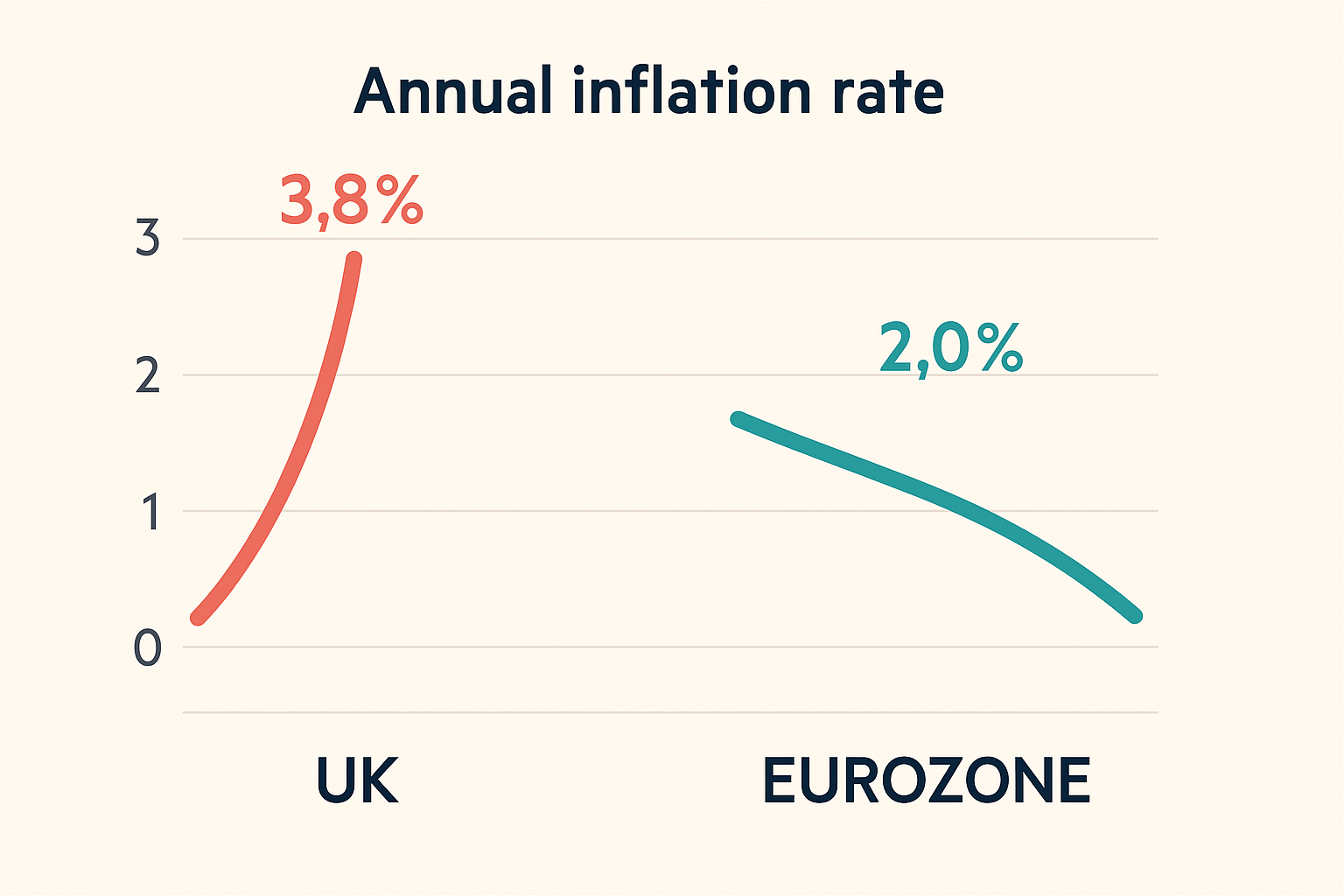

New figures show UK inflation accelerating at a pace that has widened the gap with the Eurozone to its largest margin since September 2023, highlighting the mounting challenges for the Bank of England (BoE).

Inflation Trends in the UK and Eurozone

The UK’s Consumer Prices Index (CPI) rose 3.8% year-on-year in July, up from 3.6% in June, according to the Office for National Statistics (ONS). The reading surpassed expectations and marks the highest level since January 2024.

By comparison, inflation in the Eurozone remained steady at 2%, based on data from Eurostat. France recorded particularly low inflation at 0.9%, while other major Eurozone economies posted more moderate figures: Germany at 1.8%, Italy at 1.7%, and Spain at 2.7%.

The resulting 1.8 percentage point gap between the UK and the Eurozone is the widest in nearly two years.

Drivers of Inflation in the UK

Analysts attribute the UK’s stronger price pressures to several factors:

- Wage growth and labour costs: The increase in the living wage and employer national insurance contributions under Chancellor Rachel Reeves has added to inflationary momentum.

- Labour market stickiness: While the UK labour market is loosening, pay growth has not slowed as rapidly as in other regions.

- Sector-specific costs: Rising airfares, motor fuel, and food prices have driven inflation higher, with retailers passing on costs linked to new packaging waste rules and labour-related expenses.

Services inflation, a closely watched measure by the BoE, rose from 4.7% in June to 5% in July, compared with 3.2% in the Eurozone.

International Comparisons

The UK stands out among advanced economies for its persistent inflation pressures. While UK inflation accelerated from 2.2% in July 2023 to 3.8% this year, the Eurozone’s headline inflation has fallen from 2.6% to 2% over the same period.

In the US, consumer prices increased by 2.7% last month, slightly down from 2.9% a year earlier.

Policy Implications

The BoE faces a difficult balancing act: inflation is on track to reach 4% in the coming months, double its official target, even as economic growth remains subdued.

Earlier this month, the BoE cut its key interest rate from 4.25% to 4% in a narrow vote. However, the persistence of inflation has reduced expectations of further rate cuts this year.

By contrast, the European Central Bank (ECB) has maintained its key interest rate at 2%, reflecting relatively more subdued inflationary pressures across the euro area.